[amazon_link id=”1844071448″ target=”_blank” container=”” container_class=”” ] [/amazon_link]One of the most influential books on the subject of resource efficiency in the 20th Century was The Limits to Growth [ meadows1972limits ] by Donella H. Meadows, Dennis L. Meadows, Jørgen Randers, and William W. Behrens III. Commissioned in 1972 by the Club of Rome, an influential think-tank, the study used computer systems – an innovation at the time – to model the interaction of population, pollution, capital investment, agriculture and natural resources. Each of these drivers had positive and negative feedbacks with each other – e.g. as agriculture improved so did food per capita which boosted population, at the same time as population increased so too did pollution and natural resource consumption, while a decline in resources decreased industrial output.

[/amazon_link]One of the most influential books on the subject of resource efficiency in the 20th Century was The Limits to Growth [ meadows1972limits ] by Donella H. Meadows, Dennis L. Meadows, Jørgen Randers, and William W. Behrens III. Commissioned in 1972 by the Club of Rome, an influential think-tank, the study used computer systems – an innovation at the time – to model the interaction of population, pollution, capital investment, agriculture and natural resources. Each of these drivers had positive and negative feedbacks with each other – e.g. as agriculture improved so did food per capita which boosted population, at the same time as population increased so too did pollution and natural resource consumption, while a decline in resources decreased industrial output.

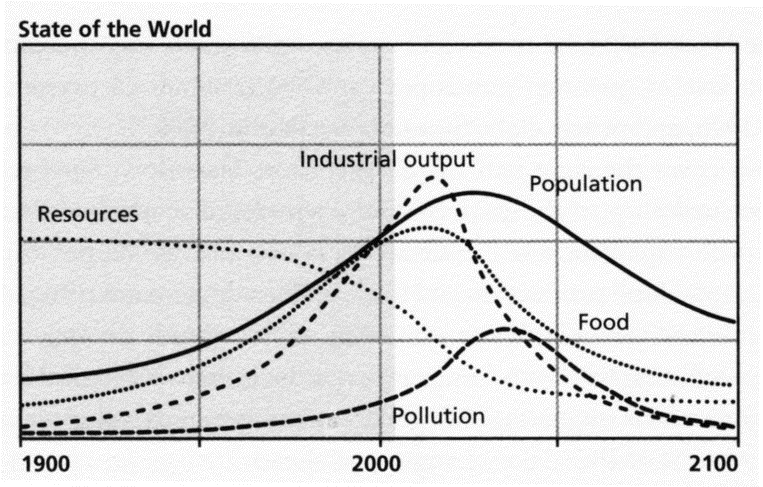

This was the first times that “systems dynamics” simulation has been applied at a global level. The model created, called World 3, was not intended to provide precise predictions (after all the world is much more complex than a computer model) but was designed to explore whether there were limits to growth, as the title implied, and what these might be. The results were quite dramatic – starting with an approximation of conditions in 1970 the base case scenario indicated that growth would decline markedly from the early 2010’s onwards. In this base scenario, shown below, pollution was not the most significant constraint to growth; rather it was the need to divert more and more capital resources to maintain the production of both food and services.

Figure 1 The “Standard Run” of the limits to growth painted a picture of resource decline, reduced industrial output and food per capita leading to declining population. {Source Scenario 1 in [ meadows2004limits ] p169}.

What the team did next was to explore whether changes in the assumptions in the model would lead to different outcomes, for example if the rate of population growth was decreased or the level industrial output was reduced. They discovered that changes to single parameters merely postponed the collapse – with more natural resources the population and industrial output simply climb higher before they collapse due to the effect of rising pollution and increasing cost of extraction of the resources. However what the model did show is that it is possible to achieve a steady state, which does not imply a large loss of material standards, by curbing population and growth and by realising large technological breakthrough in resource efficiency, switching to renewable resources, in pollution prevention and degrading less agricultural land. In other words the nature of change to avoid collapse needed to be economy-wide.

The book had an enormous impact and was translated into more than 30 languages with over 1 million copies sold. The success of the title led to a heated debate, in which many of the most vociferous critics were economists. There are a number of understandable reasons for the criticism, ranging from an initial “gut reaction” against the “Models of Doom” which seemed to challenge the prevalent view of ever-increasing prosperity; through to a sense that these questions were better dealt by economists modelling the “real economy”, i.e. econometrics, rather than being left to outsiders using an unknown (and unproven) technique; through to plain misunderstandings about how the World 3 model worked and failing to realise that is was never intended to provide a precise prediction. Ugo Bardi’s highly readable The Limits to Growth Revisited [ bardi2011limits ] provides a fascinating tale of the fierce argument sparked by book and explains what conclusions that we can properly draw from the work.

Contrasting with the “pessimistic” perspective of Meadows and others is a cadre of economists who believe that declines in resources will be more than compensated by humanity ingenuity, thus enabling us to maintain our current levels of exploitation for the foreseeable future. Such “optimists” would include Howard Barnett and Chandler Morse who, in their 1963 classic Scarcity and Growth[ barnett1963scarcity ], argued that resource scarcity did not threaten economic growth. A follow-up investigation in the late 1970s, Scarcity and Growth Reconsidered, reached largely the same conclusions. More recently, The Skeptical Environmentalist [ lomborg2001skeptical ] by Bjørn Lomborg, stated that fears about diminishing resources were exaggerated, although the basis for the conclusions in the books have since been questioned, notably in a series of articles in Scientific American [ rennie2002misleading ], called Misleading Math About the Earth. Of course there is the adage that “a pessimist is simply an optimist who is in full possession of the facts”, and the most recent follow up to Scarcity and Growth – [ toman2004scarcity ] – concludes that:

The message of Scarcity and Growth that depletion of market resources was not a problem has given way to a concern that “new scarcities” of environmental quality, global climate, and biological diversity are emerging.

In other words it is not the availability of resources per se that is the key issue, but the capacity of natural services to deal with the pollution and other damage that our consumption is creating. It is the “Sinks” rather than the “Sources” that are the main concern.

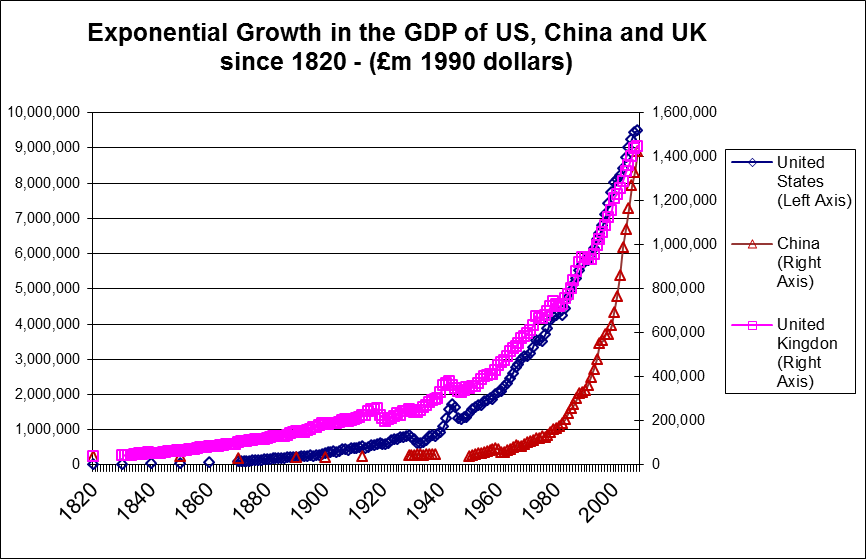

The core idea that the Limits to Growth revealed is the concept that exponential growth in a finite system will inevitably lead to diminishing returns. This idea seems complete obvious to biologists, who will be very familiar with the experiment that show yeast or bacterial populations doubling every few hour/days in a petri dish only to eventually decline as resources are exhausted or waste products accumulate to toxic levels. Economists on the other hand, seeing only the data on the upward part of the curve of human progress to date, were more inclined to either ignore the resource limits altogether or to incorporate a “Technology” factor (technically known as Solow’s residual in the economic production function models) to explain how Gross Domestic Product (GDP – a measure of the output of an economy) rises faster than expected from growth in the capital investment and labour inputs alone[1]. This residual is not insignificant and accounts for about 1.2% of the US’s average growth rate during the period 1950-2000. Naturally it is the subject of much debate by economists with some suggesting that it reflects resource efficiency – particularly in terms of the way energy is converted to useful work. One of the key questions that this assumption gives rise to is whether innovation itself is subject to the law of diminishing returns – in other words are incremental efficiency improvements going to become increasingly difficult to achieve?

In exponential growth, you get growth on top of growth. Exponential growth is what our economies are entirely based on. The idea of perpetual “year-on-year” growth has become the central assumption of our current economic paradigm – those brief periods of time when growth falters or goes into reverse are referred to as recessions and are something to be avoided at all costs. Recessions are bad because the lack of growth means, amongst other things, a decline in prosperity, reduced sales, falling incomes, and an inability to service the accumulated debts that have powered the growth in the first place. Hence our economic systems – and private business as a whole – are set up to deliver regular year-on-year growth, something which they have managed to do relatively consistently since the industrial revolution.

Figure 2 Although the UK, US and China have all started their economic growth at different times with different starting conditions we can see that they follow an exponential curve, with historic rates of growth around 8-9% per year {Data from Angus Madison “Historical Statistics of World Economy – see Maddison_GDP.xls).

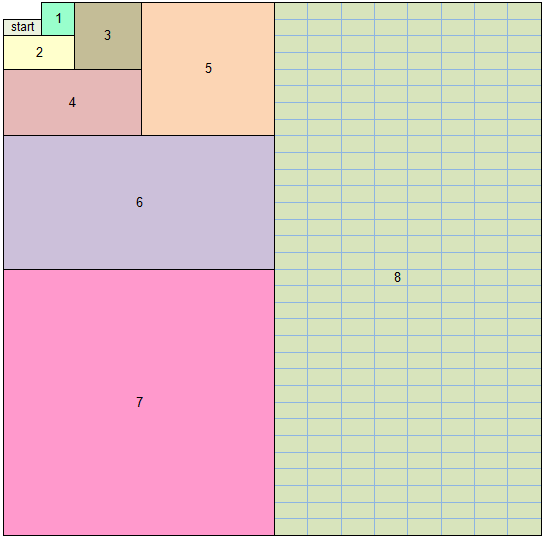

The attribute of exponential growth is that it starts slowly but after a few cycles the rate of increase can be enormously, as shown by the diagram below. Let’s imagine that we start at the box labelled “start” representing just one unit of resource, and then double this to get to box 1, and then we double at each step all the way through to box 8. We can see that after 8 doublings we are consuming 28 of our resource or 256 times our initial resource (each rectangle represents the initial resources we were using at the outset). In just three more steps our consumption will be over 2,000 times the initial rate. Another important observation is that each step consumes more than all the preceding steps added together.

Figure 3 Illustration of the concept of exponential growth in resource consumption. Each rectangle is double the area of the previous one, and is larger than the size of all the previous rectangles put together. {see excel sheet “Growth.xls”)

Of course the Global GDP has not doubled every year – in fact its average since 1960 has been 3.5% per year[ wb2012statistics ]. That does not mean to say that Global GDP is not growing exponentially it just means that the doubling time is greater than one year – it is 20.3 years to be precise (using the rule of 72 we simply divide 72 by the growth rate to get the doubling time in years). So at the current rate of growth in 20 years’ time we will be using twice the resources that we are today, and in that period we will have consumed more resources we have used in all history up to today. Some economies like China’s have been growing at an average of 10% per year since 1990; that is a doubling every 7 years, so that today they are 8 times the size they were in 1990. In just 7 more years, to maintain current rates of growth, China will need twice as many power stations, producing twice as many manufactured goods from twice as many factories, doubling the transportation of goods, consuming twice as many natural resources and emitting twice the pollution.

Perhaps the next global doubling will be achieved easily, and maybe the one after that or even the one after that. But clearly, unarguably, this process cannot continue forever where natural resources are finite. That is the key message to the Limits to Growth. The original team have produced follow-up works to the Limits, the most recent in 2004 [ meadows2004limits ] where they reiterate that the book is not a prediction, but rather a declaration that exponential growth cannot continue forever and that we can either manage our transition away from growth or face collapse. A number of independent studies have shown that the original predictions in the Limits to Growth correspond well with trends observed in the intervening 40 years, the most recent by Graham Turner at CSRIO in Australia [ meadows2004limits graham2008comparison ].

We should consider the Limits of Growth as a warning. Unless we are able to radically reduce resource consumption and industrial output, through resource efficiency, and significantly reduce damage to the environment, and reduce population growth and improve food yields, we run a risk of uncontrolled decline in human welfare. It is not all bad news, since 1980 we have increased the $ Global GDP per kg oil equivalent 1.64 times (from $4.20 to $6.84[ wb2012statistics ]) and this Handbook will demonstrate that there exists a huge potential for further improvement. However it is evident that our rate improvement in resource efficiency needs to match the growth in GDP simply to stabilise our absolute rate of resource use – and in all probability we need to reduce our rate of resource consumption much more dramatically. This is not a statement drawn from an ideological perspective – rather it is simply what the maths and science are telling us. Those organisations that can grasp this are the ones which are more likely to prosper as society (or nature) starts to impose these limits.[2]

[1] This reminds me of the old nugget: “Anyone who seems to think that exponential growth can continue forever is either mad or an economist”. With apologies to all economists reading this!

[2] For those organisations who are interested in exploring the limits of growth further there are a number of books exploring the themes of an economy without growth (or rather where growth takes a different form): The End of Growth by Richard Heinberg contains a lot of supporting material, Tim Jackson’s Prosperity Without Growth provides a well-argued and provocative view of a new economy in which organisations can thrive without the risks we face today. Jared Diamond’s Collapse and Chris Martenson’s The Crash Course are rather more apocalyptic in tone. All have merits in giving us visions of the future from which we can backcast from.

| [amazon_enhanced asin=”1844071448″ /] | [amazon_enhanced asin=”1441994157″ /] | [amazon_enhanced asin=”1905570333″ /] |

| [amazon_enhanced asin=”1849713235″ /] | [amazon_enhanced asin=”0241958687″ /] | [amazon_enhanced asin=”047092764X” /] |

Your conclusions are correct, but there are few ways to slow consumption. A new study I read recently by a group called osmosis shows that companies who are managing resources more efficiently deliver greater shareholder returns. We can hope therefor that other companies follow suit, and investors reap the gains